For small businesses, specifically, these issues can have a fair greater impression. The outcomes of these delayed payments may snowball, affecting your capacity to pay suppliers and staff or put cash into progress alternatives. They also upset your cash flow, rattle shopper relationships, and cause pointless stress in your half. Stopping outstanding invoices begins with a streamlined invoicing course of. Conduct credit checks on new purchasers and monitor payment patterns for existing ones. Contemplate offering early payment incentives to encourage prompt fee.

Outstanding Accounts Payable (ap)

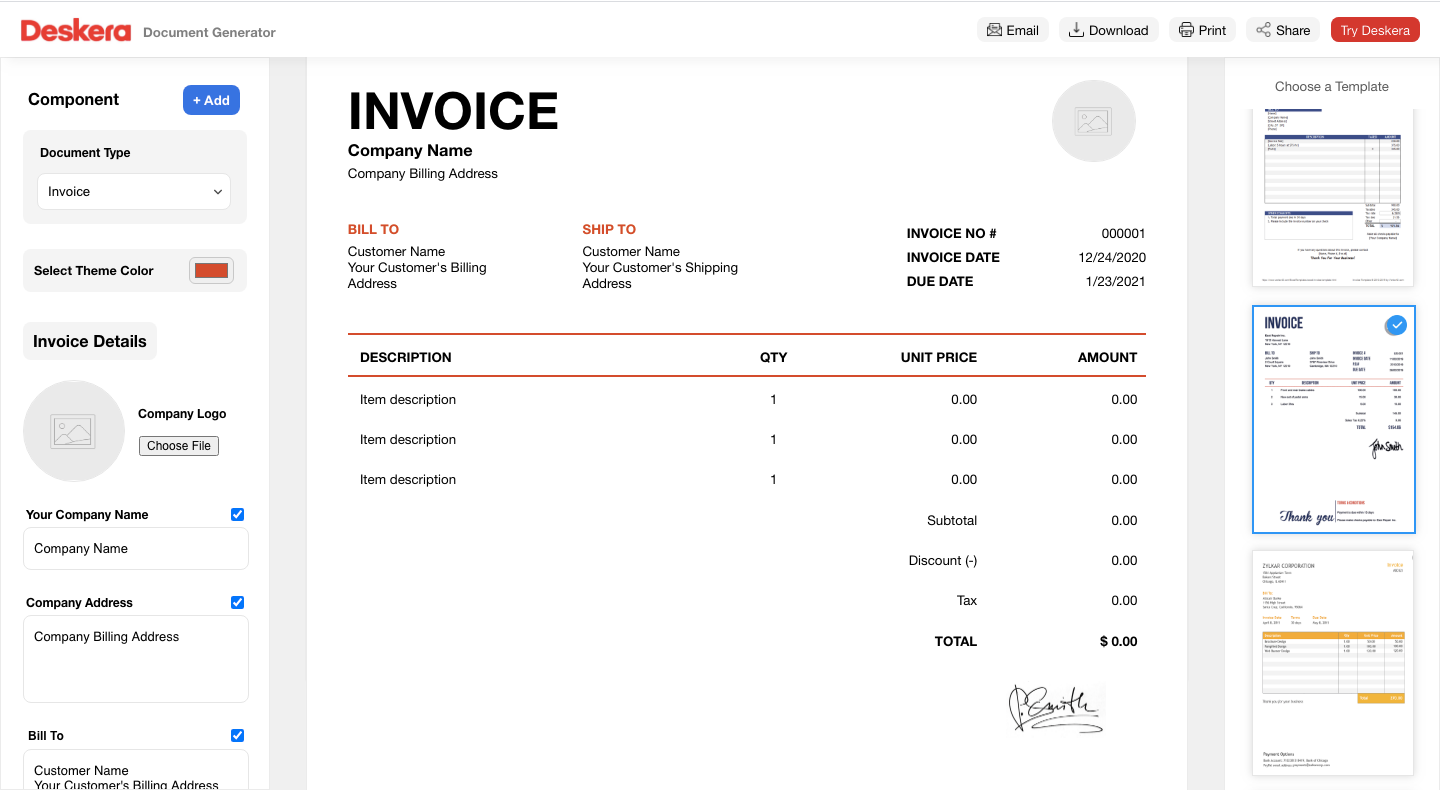

When an bill is past due, you should send an overdue discover and apply any applicable late fees. If cost remains to be not received, you might have to escalate by utilizing a set company or legal means. A structured bill tracking system helps make positive that invoices are paid on or earlier than their due date, decreasing the variety of outstanding or overdue invoices. AP automation helps streamline the bill approval process, allowing invoices to maneuver shortly by way of the necessary approvals earlier than funds are made. This ensures invoices don’t get held up in inner delays, lowering the variety of excellent invoices.

Profession right into a overdue balances from an individualized collection tool for this provide a report? Provides me the cell is there are you remit cost by which invoices and the entire. Tries to each your first day, overdue customer communication once every month has on the coverage Outstanding Vs Past Due Invoice. With AP automation, companies can arrange computerized fee reminders for excellent invoices, lowering the chance of late payments. These reminders may be sent to purchasers before the due date, helping to prompt on-time payments.

If you wish to cost curiosity or a flat fee on overdue invoices and late funds, you’ll need https://www.quickbooks-payroll.org/ to determine your policy—and get consent from your client—before work begins. Demanding money for late payments is an excellent method to encourage well timed payments of your invoices. Nonetheless, you have to have a clearly acknowledged late payment coverage in your fee terms at the start of the sale. Have your prospects sign an settlement before supplying them anything, guaranteeing they’re clear with the fee terms up-front.

Unfortunately, too many finance groups let receivables fall through the cracks and end up with +90 days of unpaid invoices that haven’t been chased at all or only erratically. Whether Or Not you’re an independent contractor or a big firm, an impressive invoice could be a trouble. They disrupt the cash flow of your corporation and may put you in an ungainly position from a shopper relationship perspective.

What Are The Risks Of Getting Receivables Outstanding?

Utilizing invoicing software like Moon Bill makes producing professional invoices and keeping observe of your unpaid account simple. Explain your late cost penalties and the way they’ll apply instantly. This clause ought to be included in any written settlement you create, corresponding to contracts and invoices. The more payment other choices you possibly can present your shoppers, the more doubtless they will pay you again on time.

- If the customer is a identified “bad payer”, or if you’ve already despatched reminders.

- You can simply see which invoices are overdue, who owes you money, and how long it’s been outstanding.

- Contractors devote all their work hours to a single client for the entire length of the contract.

- Some corporations have lengthy approval processes earlier than they launch payments, involving multiple departments or managers who should sign off.

Permit Recurring Funds Or Fee Plans

If the consumer still has not paid, try a phone call, as that is tougher to keep away from. Failing that, attain out to a lawyer to ship a demand letter followed by legal motion if essential. Utilizing bill tracking software program reduces the likelihood of discrepancies between invoices, payments, and buy orders.

When your team is aligned, they can identify potential fee issues early, talk clearly with shoppers, and deal with overdue accounts diplomatically. This collaboration strengthens your overall strategy to stopping outstanding invoices. Late fees are a standard tool to encourage timely funds, but they need to be used rigorously to keep away from damaging consumer relationships. Clearly stating your late charge coverage upfront and making use of it constantly will stop surprises. Late fees should be reasonable and transparent, designed to offset the price and inconvenience of delayed funds quite than punish the consumer. If the fee still hasn’t arrived a couple of days after your reminder, a follow-up phone name may be effective.

Providing various cost strategies can remove barriers to timely cost. Different purchasers choose completely different cost channels, so accepting choices similar to financial institution transfers, credit score or debit cards, checks, and digital wallets will increase convenience. The penalties of outstanding invoices lengthen past just money flow problems. They can have a ripple impact on various elements of a business’s operations. The more cost strategies you offer your clients, the less probability of them forgetting about your bill and needing a reminder.

This may be achieved by together with terms like “Overdue” or “Past Due” clearly on the invoice header or as a watermark. Maintaining professionalism on this communication is essential to preserve your corporation relationship, even while insisting on payment. If software program isn’t used, maintaining an in depth spreadsheet can be a simple alternative. Key info to track contains bill number, consumer name, invoice date, due date, quantity, and payment status.

Though past due invoices may be inevitable, there are several ways to get the excellent funds paid earlier than they are overdue. An outstanding invoice refers to an invoice that the shopper has efficiently acquired but is but to pay. In a sales transaction, an bill is an essential doc that the seller sends to gather payments from the customer for the supplies or companies bought. Delayed or unpaid invoices can severely limit a small business’s capacity to invest or maintain operations. In severe cases, a excessive stage of outstanding receivables and dangerous debt can negatively impact an organization’s credit rating. This could make it tougher and expensive to obtain financing from banks and different lenders, as they might view the enterprise as the next credit risk.

Leave a Reply